Letter to Investors

August 30, 2022

A request for engagement with Mitsui & Co.

regarding its new fossil gas projects and ammonia co-firing

Friends of the Earth Japan

Kiko Network

Japan Center for Sustainable Environment and Society (JACSES)

Mekong Watch

350.org Japan

We, the following Japanese civil society organizations are writing to request that 39* major shareholders engage with Mitsui & Co. and urge Mitsui officials to reconsider its participation in new fossil gas projects, such as Browse LNG project and Block B – O Mon gas project, and the Ammonia co-firing introduction at Safi Coal-fired Power Plant. Mitsui’s fossil fuel operations present a significant climate and reputational risk to investors.

One of the key principles of the Paris Agreement is to make finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development. Investors have a responsibility to ensure that their managed assets are consistent with this agreement. Thus we request that you consider the significant risks of Mitsui’s fossil fuel operations and incorporate these concerns into your engagement with Mitsui to ensure that the company does not proceed with climate destructive projects.

Climate change presents significant risks

The global temperature has already increased 1.2 degrees Celsius from the pre-industrial level and the impact of climate change is already appalling all over the world. It is reported that fires accounted for more than a third of the world’s tree cover losses last year, the largest losses on record. An UN expert reported of 59.1 million people internally displaced last year across the world, most were displaced by climate-related disasters, far higher than displacement due to armed conflict.

While Mitsui reports that they are conducting physical risk assessment based on climate disasters that have occurred in the past five years in their Disclosure Based on TCFD Recommendations, it is unclear to what extent the severeness of such climate impacts are assessed. Also, whether the company is recognizing the fact that their fossil fuel business is the cause of these physical risks is doubtful. Mitsui sees the expansion of the market for LNG businesses as unmitigated opportunities instead of determining whether they present climate risks.

The latest Intergovernmental Panel on Climate Change (IPCC) report revealed that “projected cumulative future CO2 emissions over the lifetime of existing and currently planned fossil fuel infrastructure without additional abatement exceed the total cumulative net CO2 emissions in pathways that limit warming to 1.5°C (>50%) with no or limited overshoot. They are approximately equal to total cumulative net CO2 emissions in pathways that limit warming to 2°C (>67%)”. This means that, in order to limit the temperature increase to below 1.5 degrees Celsius, a target agreed in the Paris Agreement, companies must stop expanding or exploring new fossil fuel projects besides phasing out existing infrastructure including coal power plants.

Mitsui’s is out of line with its own commitments

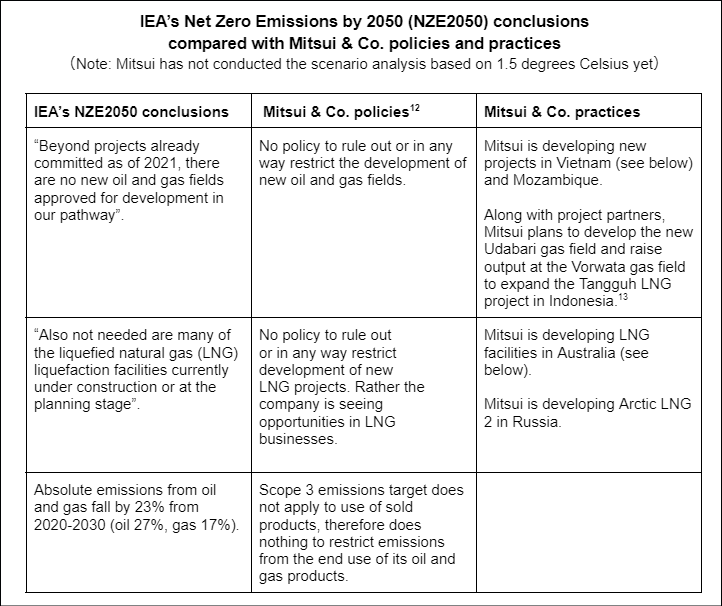

Mitsui & Co. has notably committed to achieve Net Zero Emission by 2050, however, in a pathway indicated by the International Energy Agency (IEA), no new oil and gas field could be approved for development from 2021 if the world was to reach net zero by 2050. Mitsui’s pursuit of new fossil gas projects completely deviates from this drawn pathway.

Gas consists primarily of methane, which is 80 times more potent than carbon dioxide over a 20-year period. Methane is leaked along the entire gas supply chain and has reached record levels in the atmosphere. IPCC reports that the next few years are critical in order to limit warming to around 1.5 degrees Celsius, requiring massive reduction of methane also.

According to the “Global Oil & Gas Exit List” (GOGEL) , an extensive public database by Urgewald that covers 887 oil and gas companies, which account for almost 95% of global oil and gas production, Mitsui & Co. is one of the companies with a significant portfolio. Mitsui & Co. accounted for the largest investment in upstream hydrocarbon production (oil, gas, condensate, and NGL) in 2020 amongst the five major Japanese trading companies and is one of two trading companies (Mitsui & Co. and Itochu) investing in midstream pipelines under development. GOGEL has identified three projects with adverse effects beyond GHG emissions that are so harmful that they pose a reputational risk to their financial backers:

- Australia’s Scarborough Gas Field and Burrup Hub which includes the Browse LNG project

- Yamal LNG and Arctic LNG 2: Gas extraction in the Russian Arctic, and

- Cabo Delgado, Mozambique: A resource-rich War Zone.

Risks flowing from Browse LNG in Australia

Mitsui & Co., through its 50% owned subsidiary MIMI, has a 7.2% share of the Browse gas fields and a 8.3% share of the North West Shelf (NWS)’s Karratha Gas Plant(KGP). Browse LNG project is a project to develop new offshore gas fields in Western Australia, and to liquify the gas into LNG. The gas extracted from the Browse fields would be exported through a proposed 900km pipeline to the existing North West Shelf (NWS) Project’s Karratha Gas Plant (KGP). The NWS KGP is the oldest facility in Australia, operating since 1984, and currently proposed to extend its life until 2070 without major upgrades to technology or equipment to make the facility more efficient. The Browse LNG project is to provide backfill for the NWS KGP.

Browse LNG project could devastate marine life in a globally significant biodiversity hotspot. The gas development involves drilling 54 wells in and around the Scott Reef, the largest offshore coral reef in Western Australia, to extract gas from directly beneath the reef itself. The reef hosts nesting feeding and/or migratory sites for endangered green sea turtles and provides crucial habitat to many other marine species including whales and dugongs. If there is a well blow out, it would pollute Scott Reef Nature Reserve, Argo-Rowley Terrace Marine Park, Mermaid Reef Marine Park, and Rowley Shoals Marine Park, and would put 39 threatened animal species at risk, according to the project proponent’s own assessments.

Mitsui & Co. has had stakes in the Browse gas fields since 2012. The plan to develop the remote carbon-intensive offshore fields containing between 8% and 12% CO2 has been technically and commercially challenging. In response to environmental concerns, the project proponents are now looking at installing a carbon capture and storage (CCS) facility. This project is still in the early stages of development as a timeline for final investment decision has not been determined, environmental approvals have not been granted and a CCS plan has not been prepared. Investment in this project will undermine our chances of avoiding climate catastrophe and securing a livable planet.

Risks presented by Block B – O Mon Gas Project in Vietnam

Mitsui & Co., through its wholly owned subsidiary Mitsui Oil Exploration Co. Ltd. (MOECO) has stakes in the Block B (Lot B&48/95 and Lot 52/97) gas field. Block B – O Mon Gas Project in Vietnam includes the development of an offshore gas field “Block B” and pipeline which would deliver gas to a planned O Mon power complex. The 3,810MW O Mon power complex consists of four power plants; only one of which (660MW) is built and now operated with fuel oil when emergency power supply is needed.

The company has sought public finance support for pipeline construction from Block B, which the Japan Bank for International Cooperation (JBIC) is now considering. According to an 2018 approved environmental impact assessment (EIA) report that was posted on JBIC’s website on May 31, 2022, the project contains various contents, including construction of undersea and on land gas pipeline to connect the gas field with O Mon via Kien Giang, landing stations, distribution stations, branch pipeline to Ca Mau, etc.

The project would also provide gas supply to the planned Kien Gian power complex (in total 1,500 MW planned) and Ca Mau power plant (1,500 MW currently operating with gas from offshore PM3 CAA field). In addition to the methane leakage problem mentioned above, massive GHG emissions from gas burning at these large scale power plants for the coming decades would further exacerbate the climate crisis.

Instead of investing in new gas infrastructure, Mitsui & Co. should support cleaner energy solutions, especially considering that Southern provinces of Vietnam where the gas from Block B gas field is planned to be delivered have high potential of solar and wind, and even offshore wind as a possibility. Mitsui itself has admitted that it needs to shift, stating, “Considering the scenario of declining demand (for offshore oil and gas production facilities business) in the medium to long term, we will work to transform our businesses into a field where we can utilize the expertise we have accumulated from our existing business (e.g., floating offshore wind power)”. Thus the company should leapfrog to offshore wind and wind down its oil and gas operations, rather than expanding into new sources.

Safi coal-fired power plant project in Morocco: Ammonia co-firing study

Mitsui & Co. has a 30% share of Safi coal-fired power plant in Morocco. The company received a Japanese Government subsidy to conduct a feasibility study on ammonia co-firing introduction at the plant. Ammonia co-firing is an uncertain technology; its practical and commercial viability and its abatement effect is questionable. As such it is nothing short of imposing a false solution for the energy transition.

Mitsui & Co. ‘s continuing support for fossil fuels is undermining global actions to mitigate the climate crisis and its own commitment to net zero by 2050. We kindly request that you engage with Mitsui & Co. and urge Mitsui leaders to stop developing new fossil gas projects such as Browse LNG in Australia and Block B – O Mon in Vietnam. Mitsui should also stop promoting and developing false solutions like ammonia co-firing at coal-fired power plants which would prolong their lifetime and lock in further GHG emissions.

We kindly request your reply by October 5th to the below contact addresses regarding engagements made or plans to engage with Mitsui & Co.. At the same time, we appreciate receiving any opinions with regard to the responsibilities you find in addressing our concerns stated above.

Sincerely,

Friends of the Earth Japan

Kiko Network

Japan Center for Sustainable Environment and Society (JACSES)

Mekong Watch

350.org Japan

*Download : PDF with footnotes is available from here.

Addressed to

*We wrote 39 in the letter but the actual number was 38 compnies/organizations listed below.

Nomura Group

Mizuho Financial Group

The Vanguard Group

Nippon Life Insurance Company

Nikko Asset Management

Daiwa Securities Group

Sumitomo Mitsui Financial Group

BlackRock

Norges Bank Investment Management (NBIM)

JP Morgan

Barclays

MS&AD Insurance Group Holdings

Nuveen, LLC

Sumitomo Mitsui Trust Holdings

CPP Investment Board

California Public Employees’ Retirement System

California State Teachers Retirement System

Schroders

APG Asset Management N.V.

Dimensional Fund Advisors, L.P.

Amundi Asset Management, SAS

State Street Global Advisors

Credit Suisse Asset Management

Caisse de Depot et Placement du Quebec

PGGM Vermogensbeheer B.V.

Goldman Sachs Asset Management, L.P.

Allianz Global Investors GmbH

UBS Asset Management (UK) Ltd.

Legal & General Investment Management Ltd.

M & G Investment Management Ltd.

Grantham Mayo Van Otterloo & Co. LLC

Deka Investment GmbH

Första AP-Fonden

Danske Bank Asset Management

Fidelity International

Nordea Investment Management AB (Denmark)

Federated Hermes

Resona Holdings

Contact regarding this letter:

Japan Center for a Sustainable Environment and Society (JACSES)

Yuki Tanabe tanabe[@]jacses.org